Get the free mexico commercial invoice form

Show details

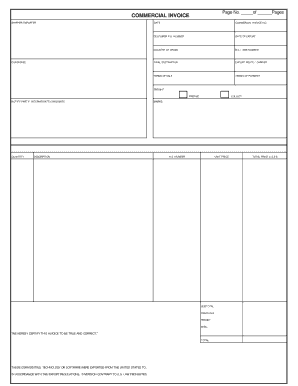

MEXICO COMMERCIAL INVOICE Factura Comercial Para M xico Exportador/Vendedor Exporter/Vendor N mero de Factura Invoice No. Lugar y Fecha de Emisi n de la Factura Place and date of Issuance of Invoice P is de Origen de la Mercancia Origin If shipment includes goods of different origins enter origins in description field. Destinario Final Ultimate Consignee Fabricante Producer Destinario Intermedio Intermediate Consignee Otras Referencias e Instrucciones para Consignaci n Other References Agente...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your mexico commercial invoice form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mexico commercial invoice form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mexico commercial invoice online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mexico invoice template form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Check it out!

How to fill out mexico commercial invoice form

How to fill out a Mexico customs invoice:

01

Start by providing your company’s name, address, and contact information at the top of the form.

02

Include the recipient's name and address in the designated section.

03

Enter the date and invoice number for reference.

04

Clearly describe each item being shipped, including the quantity, unit price, and total value.

05

Indicate the country of origin for each item.

06

Specify the currency being used for the transaction.

07

Declare the total value of the shipment in the corresponding section.

08

Include any additional charges or fees, such as shipping or insurance, if applicable.

09

Sign and date the invoice.

10

Keep a copy for your records.

Who needs a Mexico customs invoice:

01

Companies exporting goods to Mexico.

02

Individuals shipping items internationally to Mexico.

03

Suppliers or manufacturers sending shipments to customers in Mexico.

04

Importers bringing goods into Mexico.

05

Anyone involved in cross-border trade with Mexico.

Fill blank us to mexico customs invoice form : Try Risk Free

People Also Ask about mexico commercial invoice

Do you need commercial invoice for Mexico?

Who provides the customs invoice?

How do I write a customs invoice?

Do you need a customs invoice for documents?

What is a customs invoice form?

Who prepares customs invoice?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is mexico customs invoice?

A Mexican Customs Invoice is a document that is required when goods are imported into Mexico for commercial purposes. It is used by Mexican customs authorities to assess duties and taxes on the imported goods. The invoice must include the description, quantity, and value of the goods, as well as the country of origin and the importer's information.

How to fill out mexico customs invoice?

1. Begin by filling out the invoice number and date.

2. Enter the name and address of the exporter.

3. Enter the name and address of the importer.

4. Enter the name and address of the manufacturer of the goods.

5. Enter a detailed description of the goods, including the quantity, unit price, and total value.

6. Enter the Harmonized System (HS) code for the goods being imported into Mexico.

7. Enter the transportation method and estimated date of arrival.

8. Enter the payment terms and any special instructions.

9. Sign and date the form.

What is the purpose of mexico customs invoice?

The Mexico Customs Invoice is a document used by Mexican Customs to identify imported goods, assess duties and taxes, and ensure that all imports meet Mexican legal requirements. The invoice is an important part of the import process, as it helps to ensure that all imported goods are properly accounted for and that the proper duties and taxes are paid.

When is the deadline to file mexico customs invoice in 2023?

The exact deadline for filing a Mexico customs invoice in 2023 is not yet known. It is best to contact the Mexican Customs Agency for the most up-to-date information.

What is the penalty for the late filing of mexico customs invoice?

The penalty for late filing of Mexican customs invoices can vary depending on the type and amount of the invoice. Generally, the penalty is a fixed amount of MXN$1,000 (approximately US$50). In addition, late filing may also incur additional fines and penalties, such as the suspension of import permits.

Who is required to file mexico customs invoice?

The exporter or the shipping company is typically required to file the Mexico customs invoice.

What information must be reported on mexico customs invoice?

When importing goods into Mexico, the following information must be reported on a customs invoice:

1. Shipper details: Name, address, and contact information of the exporter or shipper.

2. Consignee details: Name, address, and contact information of the importer or consignee.

3. Invoice details: A unique invoice number, invoice date, and currency used for the transaction.

4. Description of goods: A detailed description of each item being imported, including quantity, unit value, and total value. It should include the Harmonized System (HS) code for each item.

5. Country of origin: The country where the goods were produced or manufactured.

6. Transportation details: The method of transportation being used, such as air, sea, rail, or land. It should also include the name of the carrier and the mode of transport (container, truck, etc.).

7. Total weight and measurements: The total weight of the shipment and its dimensional measurements, including length, width, and height.

8. Incoterms: The agreed-upon international trade terms that define the responsibilities and obligations of the buyer and seller. Commonly used Incoterms include EXW, FOB, and CIF.

9. Terms of payment: The agreed-upon method and terms of payment, such as prepayment, letter of credit, or open account.

10. Insurance details: If applicable, the value of insurance coverage and its provider.

11. Packaging details: The type and quantity of packaging used for the goods.

12. Additional charges: Any additional charges related to the shipment, such as handling fees or customs duties.

It is important to note that specific requirements may vary depending on the nature of the goods being imported and the specific customs regulations in Mexico.

How can I send mexico commercial invoice to be eSigned by others?

When your mexico invoice template form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit invoice customs mexico online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your mexico customs invoice and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I edit mexico customs form pdf on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as mexico invoice goods form. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your mexico commercial invoice form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Invoice Customs Mexico is not the form you're looking for?Search for another form here.

Keywords relevant to invoice customs mexican form

Related to mexico invoice

If you believe that this page should be taken down, please follow our DMCA take down process

here

.