Mexico Commercial Invoice free printable template

Fill out, sign, and share forms from a single PDF platform

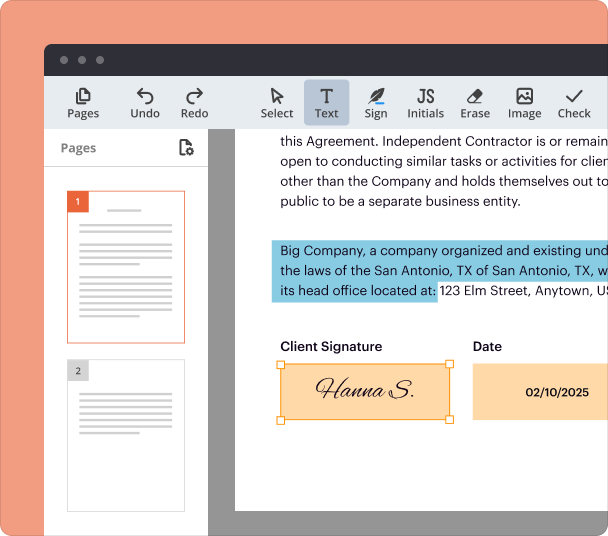

Edit and sign in one place

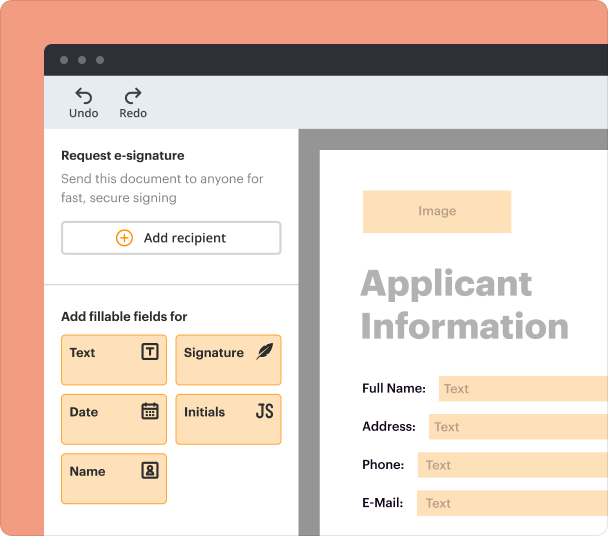

Create professional forms

Simplify data collection

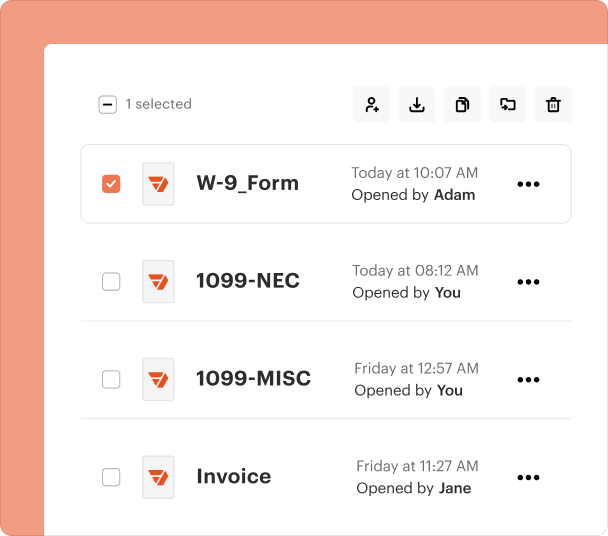

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

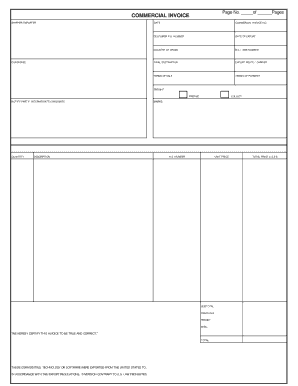

Understanding the Mexico Commercial Invoice Printable Form

What is the Mexico commercial invoice printable form

The Mexico commercial invoice printable form is a vital document used for customs clearance during international trade. It serves as a bill for merchandise sold and outlines details such as the seller, buyer, and specific products involved in the transaction. This document is crucial for both exporters and importers, ensuring compliance with customs regulations. The invoice must include precise information about the goods, their origin, and the value, facilitating efficient processing at borders.

Key features of the Mexico commercial invoice printable form

This form includes several essential elements that make it functional for international trade. Key features comprise the invoice number, date of issuance, details of the exporter and consignee, descriptions of the goods, and their total value in U.S. dollars. Additionally, it outlines payment and shipping terms, providing clear instructions for handling and transportation of the goods. Accurate completion of each section ensures compliance with Mexican customs requirements.

How to fill the Mexico commercial invoice printable form

Filling out the Mexico commercial invoice printable form requires careful attention to detail. Start by entering the invoice number and date of issue. List the exporter’s details, including name and address, followed by the ultimate consignee's information. Provide a thorough description of the goods, including quantity, weight, and values, ensuring the descriptions are in Spanish as required by Mexican authorities. Validate the information against legal requirements to avoid customs delays.

Best practices for accurate completion

To minimize errors when completing this form, it is important to double-check all entries against receipts and shipping documents. Use clear and concise language in product descriptions and ensure that all numerical values are accurate. Additionally, consider consulting with a customs expert to understand specific requirements related to trade with Mexico. This preparation can prevent potential issues with customs and ensure timely processing of shipments.

Common errors and troubleshooting

Common errors in completing the Mexico commercial invoice printable form include incorrect currency values, misrepresentation of goods, and incomplete consignee information. These mistakes may lead to shipment delays or penalties. If an error is identified, it is advisable to correct it promptly and reissue the invoice to prevent complications during customs clearance. Keeping a checklist of required fields can aid in ensuring accuracy.

Frequently Asked Questions about mexico customs invoice form

What details are required on the Mexico commercial invoice?

Key details include the invoice number, date, exporter and consignee information, a detailed description of each item, total value in U.S. dollars, and shipping terms.

Is there a specific format for the Mexico commercial invoice?

While there may not be a strict format, certain key elements must be included, and it is preferable for the product descriptions to be in Spanish.

pdfFiller scores top ratings on review platforms